Most of us pay to have our taxes completed, whether that means hiring an accountant to fill out the forms for us, or using one of the several online or application-based options made available by TurboTax, TaxACT, TaxSlayer, H&R Block, and the like. What you may not know is that many tax filers are eligible for a Free File program, which lets them file their taxes online for free—thanks to a public-private partnership between the IRS and online tax services that’s been available for a couple of years now.

Last tax filing season, while you may have qualified for free filing, if you searched for “file my taxes for free” using your favorite search engine, the information for how to do so likely eluded you. In fact, one of my daughters, who technically qualified for free tax filing last year, ended up paying to file her return because she had 1099 income, even though that should not have disqualified her.

Obscuring the facts

Right before last year’s tax-filing season ended, ProPublica, an independent, nonprofit news gathering and journalistic organization, revealed that some tax prep sites were intentionally hiding their true free-file options from search engine indexing. Additionally, companies named products in deceiving ways so it was difficult to tell the difference between a product you were going to pay for and a product that was actually free. All in all, about 14 million Americans were charged for tax prep that should have been free.

Free at last

Thanks to ProPublica’s diligent reporting, Free File options should now appear when you search the internet for free tax-filing options—the results are no longer hidden. Unfortunately, it is still possible to find tax-filing products that appears free until you get to the end of the process of filling out your forms. To make things clearer and simpler, here’s the skinny on how to figure out if you’re eligible to file your taxes for free.

Who qualifies for free tax filing?

According to the IRS website, the Free File Program is “a partnership between the IRS and the Free File Alliance, a group of industry-leading private-sector tax-preparation companies that have agreed to provide free commercial online tax-preparation and electronic filing.”

IRS

IRS

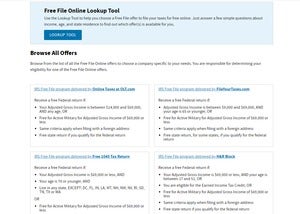

An IRS Lookup Tool helps you find the free-filing option for your specific circumstances.

According to the IRS rules, there is only one threshold you need to meet in order to file your taxes for free. You must have 2019 income of $69,000 or less.

But, while this is the IRS threshold, each of the online tax-filing companies has their own set of rules to determine free tax-filing eligibility. So you can’t just run over to the TurboTax or H&R Block website and file your taxes for free. And, as noted above, you may not learn that you have to pay to file your taxes until after you’ve done all the onerous work of entering your personal information. It’s difficult, at that point, to want to do it all again in another program.

Fortunately, the IRS provides detailed information on its website about the Free File Program and a link to a page detailing all of the available free file options available. There’s also a link to a nifty tool that lets you enter your specific income information, including where you live and whether you need to file a state return, which will list links to all of the available options that match your specific situation.

Did you make more than $69,000? You can still file for free

Believe it or not, this is true! But there’s an important caveat. You’ll need to know how to do your taxes yourself in order to use this service.

The IRS’ Free Fillable Forms does provide line-by-line instructions for each form you need to file, and does the math within those forms, but it also requires that you have your return from 2018 available, and offers no specific tax guidance, which is the hallmark of the tax-filing apps you have to pay for.

In short, while almost anyone can use these forms to file their taxes for free, you won’t get any hand holding here or any flags for errors or warnings about potential audit issues. So be aware that the onus is on you to make sure every number is correct and that you’ve filed everything you need to.

"how" - Google News

February 24, 2020 at 06:30PM

https://ift.tt/2VgMIU5

How to file your taxes for free - PCWorld

"how" - Google News

https://ift.tt/2MfXd3I

Bagikan Berita Ini

0 Response to "How to file your taxes for free - PCWorld"

Post a Comment