When you buy a stock there is always a possibility that it could drop 100%. But on the bright side, you can make far more than 100% on a really good stock. Long term The LGL Group, Inc. (NYSEMKT:LGL) shareholders would be well aware of this, since the stock is up 162% in five years. And in the last month, the share price has gained 7.2%.

View our latest analysis for LGL Group

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

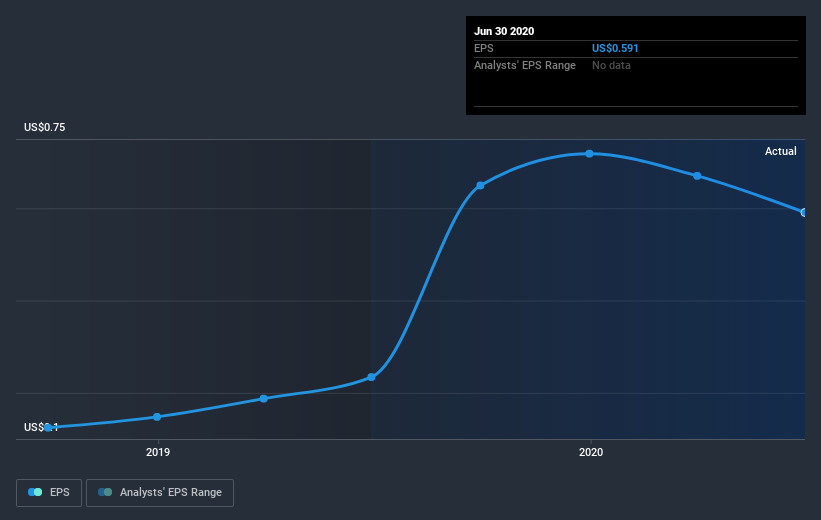

During the last half decade, LGL Group became profitable. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. Indeed, the LGL Group share price has gained 84% in three years. In the same period, EPS is up 101% per year. This EPS growth is higher than the 23% average annual increase in the share price over the same three years. So you might conclude the market is a little more cautious about the stock, these days.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We’re pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of LGL Group’s earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 20% in the last year, LGL Group shareholders lost 18%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn’t be so upset, since they would have made 21%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we’ve spotted 3 warning signs for LGL Group (of which 1 makes us a bit uncomfortable!) you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Promoted

If you’re looking to trade LGL Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

"share" - Google News

November 08, 2020 at 09:29PM

https://ift.tt/38pseiK

Is LGL Group’s (NYSEMKT:LGL) Share Price Gain Of 162% Well Earned? - Simply Wall St

"share" - Google News

https://ift.tt/2VXQsKd

https://ift.tt/3d2Wjnc

Bagikan Berita Ini

0 Response to "Is LGL Group’s (NYSEMKT:LGL) Share Price Gain Of 162% Well Earned? - Simply Wall St"

Post a Comment