Amazon Prime Day has a noticeable impact on the e-tail giant’s CPG market share — and that of other retailers, an analysis from consumer data specialist Numerator reveals.

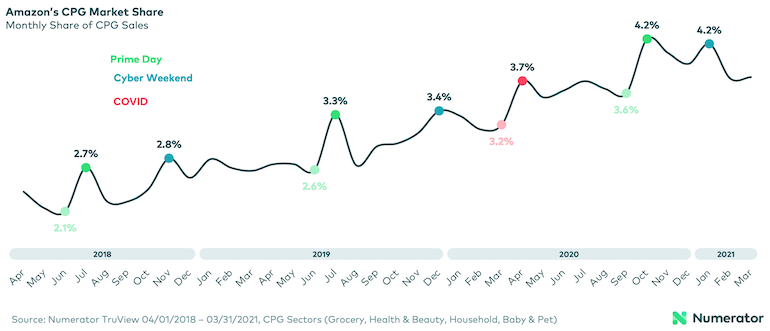

Over the past three years, Amazon’s share of CPG sales on Prime Day has averaged a 5x increase versus the company’s CPG share in the month before the annual sales event, Chicago-based Numerator said Tuesday in releasing its “A Prime View: Amazon’s CPG Share Growth” report. Amazon also sees about a 4x gain in CPG share in the same month of Prime Day. The retailer has yet to announce the date for this year’s Prime Day.

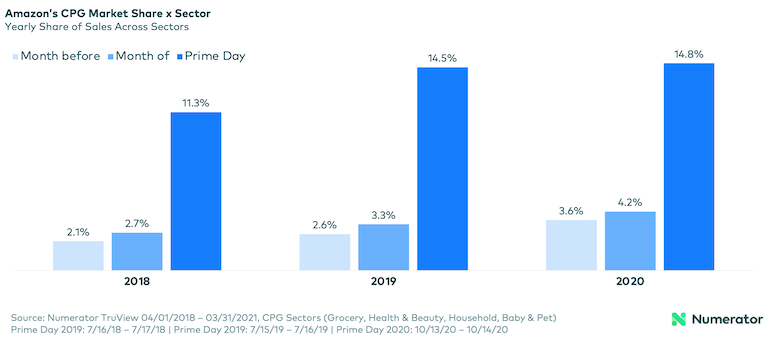

In 2020, when Prime Day was held Oct. 13 and 14, Amazon’s CPG market share jumped to 14.8% the day of the event from 3.6% in the month before. Prime Day also lifted the company’s CPG share for October to 4.2%, up 0.6% month to month.

Prime Day 2019, held July 15 and 16, hoisted Amazon’s CPG share to 14.5% the day of the event from 2.6% the month before, resulting in a 3.3% share in July. Similarly, on Prime Day 2018, held July 16, the company’s CPG share rose to 11.3% the day of the event from 2.1% in the previous month, leading to a 2.7% share for July. Prime Day 2018, which ran 36 hours, marked the first expansion of the event to more than a day, and in 2019 Prime Day was extended to a full two days.

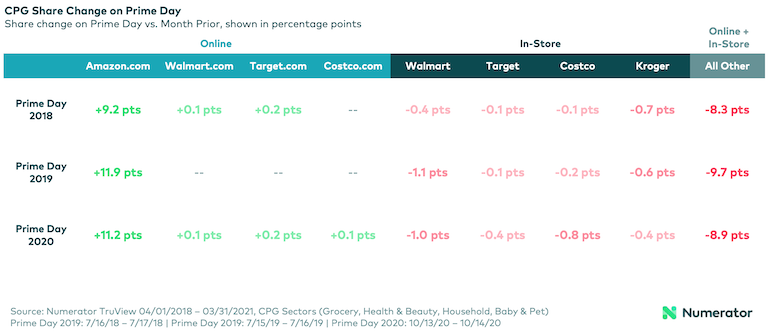

Amazon’s CPG market share gains on Prime Day come at the expense of rival retailers, mainly smaller chains, Numerator noted. On Prime Day 2020, in-store CPG share fell 1% at Walmart, 0.8% at Costco, 0.4% at Kroger and 0.4% at Target, but was down 8.9% collectively in-store and online at all other retailers. The trend was similar for Prime Day 2019 and 2018.

Numerator’s research stems from its 1 million-plus-household TruView Measurement Panel, which gauges omnichannel market share data for consumer packaged goods. The Amazon Prime Day findings, covering the period from April 1, 2018, to March 31, 2021, reflect insights from the grocery, household, health and beauty, pet care and baby care CGP categories.

“Prime Day is a window into the potential for CPG sales at Amazon. Last year, Amazon scored nearly 15% of all CPG sales on Prime Day, and share of certain categories like baby and health and beauty topped 50%,” Numerator CEO Eric Belcher said in a statement.

“Prime Day also drives a small lift for online properties more generally, as consumers price compare and focus on online shopping,” Belcher added.

Indeed, on Prime Day 2020, Amazon.com saw CPG market share surge 11.2% from the previous month, but competitors also tallied online increases, with share up 0.1% for Walmart.com, 0.2% for Target.com and 0.1% for Costco.com, according to Numerator. Other retailers offer their own promotions to counter Amazon Prime Day, including last year’s “Big Save Event” at Walmart and “Deal Days” at Target.

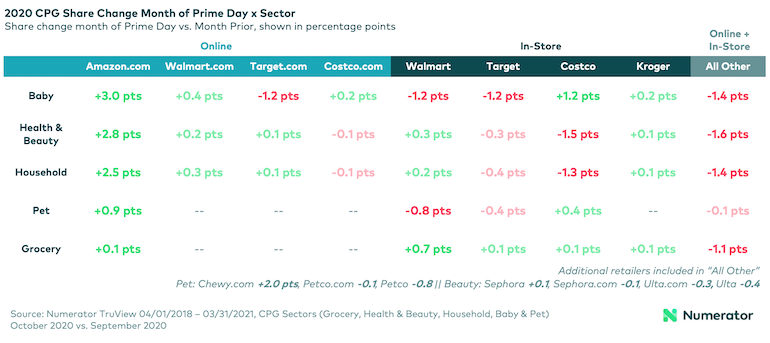

For the month of Prime Day, i.e. October in 2020, CPG share for Amazon.com edged up 0.7% versus September but also rose 0.1% for Walmart.com and 0.2% for Target.com, Numerator reported (data unavailable for Costco). The trend also extended slightly to the in-store environment, with consumers’ shopping appetite whetted by Prime Day and other retailers’ deals. In October 2020, in-store CPG share grew 0.6% month to month for Walmart and 0.1% for Kroger but dipped 0.1% for Costco (data unavailable for Target). Smaller retailers saw their in-store and online CPG share shrink 1.6% for the month.

Brick-and-mortar retailers also realized CPG market share gains last year in grocery during the month of Prime Day. In October 2020, in-store CPG grocery share rose 0.7% for Walmart and 0.1% apiece for Kroger, Costco and Target. Grocery CPG for smaller retailers fell 1.1% for the month. Online, Amazon.com gained 0.1% share in grocery.

In other categories, Amazon’s online CPG share for the Prime Day 2020 month of October grew 3% sequentially in baby, 2.8% in health and beauty aids, 2.5% in household and 0.9% in pet. Target.com saw a 1.2% decrease in baby, while Costco.com lost 0.1% in CPG share apiece in HBA and household.

Amazon’s competitors felt Prime Day’s impact more in physical stores for October 2020. Numerator tracked sequential CPG share decreases of 1.2% in baby and 0.8% in pet for Walmart; 1.2% in baby, 0.3% in HBA, 0.4% in household and 0.4% in pet for Target; and 1.5% in HBA and 1.3% in household for Costco. Smaller retailers experienced CPG share declines of over 1% across grocery, HBA, household and baby but were down 0.1% in pet.

Overall, Amazon’s share of CPG sales has climbed from 2.4% in 2018 to 3.9% year to date in 2021, for growth of 1.6x, according to Numerator, which noted that the e-tailer holds one-fifth of CPG market share in HBA and baby care.

“Both sectors have grown in the past three years, particularly since COVID, with health and beauty increasing 1.5x,” Numerator said in its report. “Alternatively, while Amazon’s grocery business has seen tremendous growth, the retailer still holds less than 1% market share for the sector.”

For the 2021 year to date, Amazon holds CPG market share of 0.9% in grocery, up from 0.8% in 2020 and 0.4% in 2018, Numerator reported. Amazon’s CPG share so far this year stands at 8.7% in household products (+3.2% since 2018), 13.6% in pet (+3% since 2018), 17.9% in HBA (+6% since 2018) and 21.4% in baby (+2.5% since 2018).

"share" - Google News

May 26, 2021 at 02:36AM

https://ift.tt/3yMiTMH

Amazon Prime Day reels in CPG market share - Supermarket News

"share" - Google News

https://ift.tt/2VXQsKd

https://ift.tt/3d2Wjnc

Bagikan Berita Ini

0 Response to "Amazon Prime Day reels in CPG market share - Supermarket News"

Post a Comment