Today after the bell, Lyft reported its second-quarter financial performance. The American ride-hailing company’s results helped illustrate just how much the economy has changed in the wake of COVID-19 and its resulting disruptions to life, travel and work.

Uber’s own results, which were shared last week, provided hints of what was coming for Lyft. The upshot: a sharply reduced ride-hailing business.

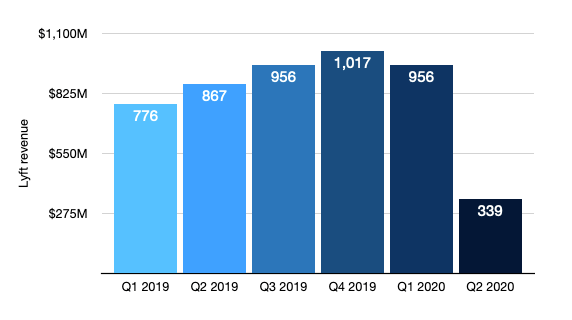

In the second quarter, Lyft reported revenue of $339.3 million and earnings per share of negative $1.41. Analysts had anticipated the company reporting revenues of $336.77 million, and a per-share loss of $0.99, according to Yahoo Finance averages.

In after-hours trading, the company’s shares are up more than 4%.

Compared to its year-ago results, Lyft’s quarter was a mess. Revenue fell from $867.3 million, or 61%, in the quarter, and its adjusted net loss in Q2 came to $265.8 million, worse than its year-ago adjusted net loss of $197.3 million. Adjusted EBITDA slipped from a $204.1 million loss in Q2 2019 to a deficit of $280.3 million in the company’s most recent quarter.

Notably, Lyft did improve its GAAP net loss compared to the year-ago period, though the company has stressed other profitability metrics in recent quarters.

Kirsten and Alex’s great How To Chart adventure.

Why are Lyft shares higher in after-hours trading? Because investors knew that Lyft’s quarter was a write-off. What they were looking for instead was a return-to-form, and a note on how much cash the company had on hand at the end of the period. Up top, Lyft answered both questions, saying that it wrapped Q2 “with $2.8 billion of unrestricted cash, cash equivalents and short-term investments,” and that “monthly rideshare rides in July were up 78% compared to April.”

That’s enough for the company to get a jolt from the public markets, despite Lyft’s operating cash flow for the first two quarters of 2020 coming to a stunning -$958.6 million.

Before we close, some other bits and bobs that stood out while we were reading the report:

- Laying off people is expensive. Per Lyft, the company saw “restructuring charges in the second quarter of 2020 included $32.1 million of severance and related employee benefit costs” in Q2.

- But only kinda. Later in the same paragraph, Lyft wrote that it “incurred a stock-based compensation benefit primarily related to the reversal of previously recognized stock-based compensation expenses for unvested awards of $49.8 million, resulting in a net restructuring benefit of $14.5 million” in the period.

- Debt isn’t always bad. As of June 30, 2020, Lyft has $623.4 million in long-term debt, net of current portion. The company raised a bunch of debt earlier this year at rock-bottom monetary rates, giving it more cushion during this period of business.

We’re keeping tabs on the company’s share price and digging into rider numbers. More to come.

"share" - Google News

August 13, 2020 at 03:26AM

https://ift.tt/2PQiB1G

Lyft shares get small bump after reporting 61% Q2 revenue decline - TechCrunch

"share" - Google News

https://ift.tt/2VXQsKd

https://ift.tt/3d2Wjnc

Bagikan Berita Ini

0 Response to "Lyft shares get small bump after reporting 61% Q2 revenue decline - TechCrunch"

Post a Comment